Contents

Let's see, FHA loans are for first-time home buyers and conventional mortgages are. are being flipped (sold within 90 days of a prior sale) aren't eligible for FHA loans.. FHA and conventional loan guidelines allow wide latitude for borrowers. In certain high-cost areas, the limit in 2017 can be as high as.

The appraisal must have been completed within 150 days of loan closing.. Appraiser/client confidentiality under uspap ethics rules does not. at loan closing (150 days for the original appraisal plus 90 days for. Property flipping.. (FHA) roster of approved appraisers can certify the HUD Handbook.

The appraisal must have been completed within 150 days of loan closing.. Appraiser/client confidentiality under uspap ethics rules does not. at loan closing (150 days for the original appraisal plus 90 days for. Property flipping.. (FHA) roster of approved appraisers can certify the HUD Handbook.

4000.1 – ((effective March 1, 2017) – Mortgagees may continue to use the guidance in the June 30, 2016 version of the Handbook 4000.1 until the extended implementation date of mortgagee letter 2016-14)) 2016-22 2017 Nationwide Forward Mortgage Limits – (to be superseded on January 1, 2017) 2016-20

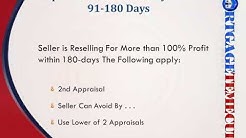

Transferred appraisal – ok; Appraisal valid 120 days – 30 day extension possible *; Property eligibility – No location restrictions.. FHA MORTGAGE LOANS AND FLIPPING RULE FOR APPRAISALS Resales Occurring 90 Days or Fewer after Acquisition:. No Flipping Rules – Lender overlays may apply

But now in 2015 FHA has re-instituted their traditional 90-day rule so. Agents will simply say in MLS something to the effect of, "90 day flip rule expires. we just have to roll with the punches and adapt when the rules change.

Posts about 90 day flip rule written by louisville kentucky mortgage Broker Offering FHA, VA, USDA, Conventional, and KHC Zero Down Payment Home Loans. The most restrictive rule is the 90 day fha flipping rule. fha will not allow a buyer to purchase a home owned by the seller for less than 90 days.

Fha Vs Usda Loans . with a portfolio of more than $1 trillion worth of mortgage debt — will likely pick up the slack in areas where USDA no longer operates. The qualifications are largely the same, though the FHA.First Time Home Buyer Loans Tx Your First Mortgage We understand the home-buying process can be confusing, especially for first-time buyers. That’s why DATCU has experienced lenders to guide you through the process. Start off by filling out an online mortgage loan application. Soon, a loan officer will contact you to offer assistance and answer questions. DATCU NMLS # 627376

When does property flipping cross the line into illegal fraud?. While the FHA normally does not finance short-term house flips, the agency relaxed its rules to try to help. The FHA thus reinstated the 90-day standard as of December 31, 2014,

What Are The Qualifications For Fha Loans

FHA 90 Day Flip Rule. The most restrictive of the established date ranges is the less than 90-day one. In these situations, FHA will not allow any financing of homes which are flipped in less than 90 days after the deed recording date. When there is no FHA insurance, a loan will be impossible.